Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more >

Ціна Jito JTO Coin (JTO) на сьогодні

Ринкові дані щодо Jito JTO Coin (JTO)

Ринкова капіталізація токена, розрахована шляхом множення циркулюючої пропозиції на поточну ціну.

Обсяг торгівлі токеном за останні 24 години. Що вищий обсяг торгівлі, то популярніший токен.

Загальна циркулююча пропозиція токенів. Якщо циркулююча пропозиція менша за максимальну, це вказує на те, що відбувається інфляція токена або його розблоковано не повністю. Якщо циркулююча пропозиція відповідає максимальній, це означає, що токени повністю розблоковано.

Максимальна кількість токенів, які буде створено. Токени без ліміту максимальної пропозиції доступні в необмеженій кількості.

Ринкова капіталізація токена, якщо всі токени перебувають в обігу. Вартість деяких токенів (особливо мем-токенів) можна встановити точніше, використовуючи FDV (повністю розведену оцінку).

Її можна розрахувати, розділивши обсяг за 24 години на ринкову капіталізацію. Вища вартість пов’язана з більшою популярністю й підвищеною чутливістю до раптових коливань цін.

Про Jito JTO Coin (JTO)

The Largest LSD Project on Solana

In the analysis of "Solana Price," it is mentioned that the development of the ETH ecosystem is saturated, lacking new narratives. A significant influx of institutional funds into Bitcoin has led to a gradual stabilization of Bitcoin's price, with the wealth effect becoming less apparent. Investors holding Bitcoin earn far more profits from investing in the Bitcoin ecosystem than from holding Bitcoin long-term. This situation is very similar to the development of Ethereum itself.

The differences between Ethereum and Bitcoin are growing, so investors are more inclined to find other public chains that can compete with Ethereum and replicate its narrative. Currently, Solana seems to be the only project capable of competing with Ethereum, which is the main reason Solana's token has surged from $19 to the current $70. The rising price of public chains, in addition to gaining more investor attention, also leads to rapid development of top projects in various tracks of public chains. The price also has significant growth potential.

Jito is the leading LSD project on Solana. The key difference from other LSD projects on Ethereum is that, in addition to reinvesting borrowed tokens to earn rewards, Jito also offers MEV rewards. MEV is a common way to "profit" in the DEFI space, simply put, by identifying orders that consume a significant amount of Gas Fee and earning the price difference through intermediaries (usually MEV bots). The problem this causes is that orders with lower Gas Fees may take a long time to execute, or the Gas Fee of the order may be higher than the order itself. Users staking Solana tokens in Jito, in addition to staking rewards, can also receive MEV rewards.

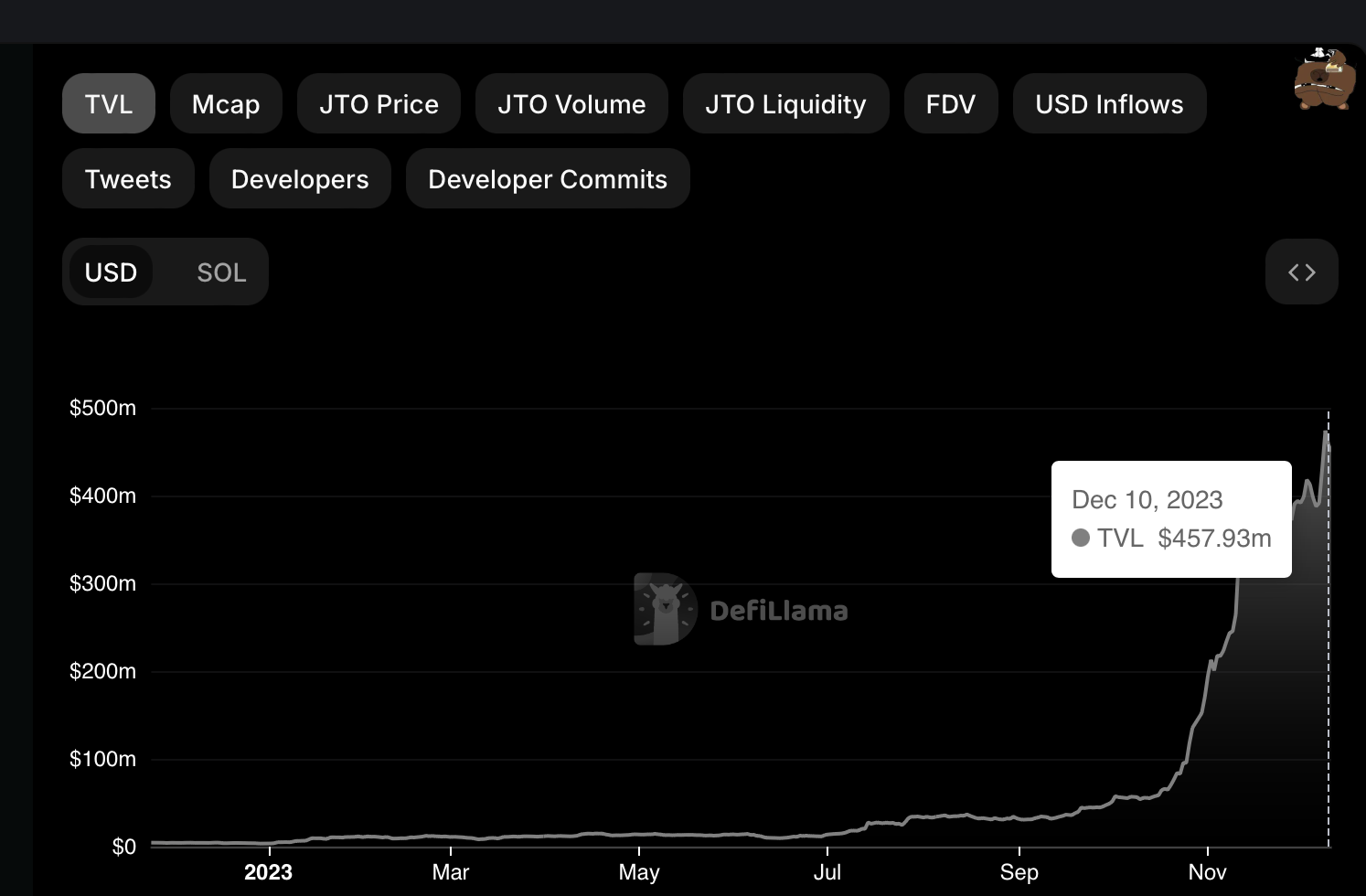

Jito is also the largest staking service platform on Solana, similar to Lido. JTO's Total Value Locked (TVL) has skyrocketed by a whopping 10 times in the past two months.

Jito's governance token is JTO, officially launched on November 28, 2023, and listed on the BingX exchange on December 8. On the day of listing, the price started to surge and reached a peak of $4.1 on the 9th (100%).

Jito Founding Team and Investment Institutions

Jito has a strong investment background, with lead investments from Multicoin Capital and Framework Ventures, and participation from Ventures and Anatoly Yakovenko, co-founder of Solana Labs.