Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more >

Dzisiejsza cena Gala (GALA)

Dane rynkowe Gala (GALA)

Kapitalizacja rynkowa tokena w obiegu obliczana poprzez pomnożenie podaży obiegowej przez jego bieżącą cenę.

Wolumen obrotu tokenem w ciągu ostatnich 24 h. Im wyższy wolumen obrotu, tym bardziej popularny token.

Łączna liczba tokenów w obiegu. Jeśli podaż obiegowa jest niższa od maksymalnej podaży, oznacza to, że token jest obecnie inflacyjny lub nie został w pełni odblokowany. Jeśli podaż obiegowa odpowiada maksymalnej podaży, oznacza to, że token został w pełni odblokowany.

Maksymalna liczba tokenów, które zostaną utworzone. Jeśli token nie ma limitu maksymalnej podaży, oznacza to, że jego podaż jest nieograniczona.

Kapitalizacja rynkowa tokena, jeśli cała podaż tokenów jest w obiegu. W przypadku niektórych tokenów użycie FDV (w pełni rozwodnionej wyceny) może zapewnić dokładniejsze oszacowanie ich wartości, szczególnie w przypadku tokenów memowych.

Jest obliczana poprzez podzielenie wolumenu z 24 h przez kapitalizację rynkową. Wyższa wartość oznacza większą popularność i większą podatność na gwałtowne wahania cen.

Informacje o Gala (GALA)

Main Reasons for Gala's Bottom Bounce Favorable to Investors

Gala faced a "Black Swan" event during the bear market, including shareholders suing each other and accusations of unauthorized node selling, leading to a sharp drop in token prices to $0.01 on October 12, 2023. However, it began to rebound just seven days later, with the price currently up more than 100%.

Gala's rapid short-term rebound can be attributed to three main factors: Web3, fundamentals, and prospects.

Gala Represents Web3 Gaming

The biggest difference between Web3 games and traditional games is that players in traditional games have no earnings besides entertainment. In Web3 games, the produced NFTs and tokens can be stored long-term. Even in the event of a Rug Pull, NFTs, and tokens cannot be deleted. In contrast to traditional games, especially online game players, who constantly spend money on various valueless items. Well-known online game companies generate annual profits exceeding $30 billion. The number of online game players over 30 is decreasing, as they transition to professional gaming due to the importance of earning money, with entertainment following the game. The strong desire of players to earn money will inevitably lead to the complete replacement of online games by Web3 games, a major reason why investors are optimistic about Web3 games.

Key Values of Gala

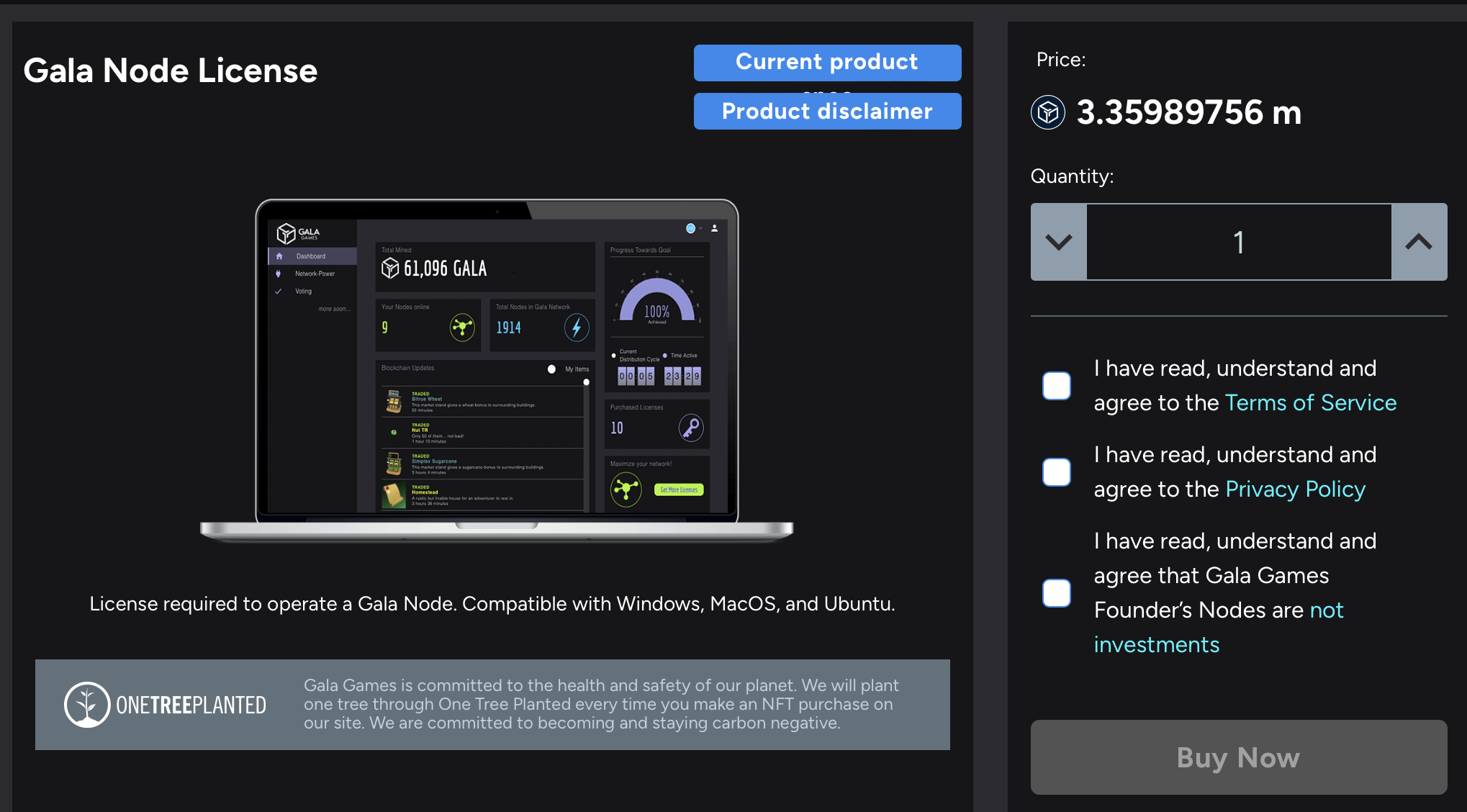

Web3 game development is slow because it lacks substantial IP support, requiring significant investment to create player-favored IPs. Such investments often result in the game's NFTs. Gala, however, takes a different approach, serving as a Web3 game distribution platform similar to Steam. Gala has its own nodes capable of running games developed on the Gala platform, providing a continuous source of value. This eliminates the financial risk of game development; as long as a game is developed or sold on Gala, Gala earns money. Consequently, Gala's game node prices continue to rise, allowing the purchase of a game node to continuously receive Gala token rewards.

The "Black Swan" event did not lead to Gala's nodes going offline or being sold off; the node's online rate remains as high as 99.8%. This indicates that investors are optimistic about Gala and do not believe that Gala will collapse as a result of this event.

Gala has not stopped releasing popular games either. On the contrary, these popular games continue to be released on Gala as scheduled. Gala's player base has not experienced a cliff-like departure; instead, many players are merely spectators. Therefore, the Black Swan event in the bear market is the perfect entry point.