Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more >

Jito JTO Coin (JTO) Price Today

Jito JTO Coin (JTO) Market Data

The market capitalization of the token in circulation, calculated by multiplying the circulating supply by its current price.

The trading volume of the token in the last 24 hours. The higher the trading volume, the more popular the token.

The total number of the token in circulation. If the circulating supply is less than the maximum supply, it indicates that the token is currently inflating or has not been fully unlocked. If the circulating supply matches the maximum supply, it indicates that the tokens have been fully unlocked.

The maximum number of the token that will be ever created. Tokens without a maximum supply limit mean their supply is unlimited.

The market capitalization of the token if the entire supply of tokens is in circulation. For some tokens, using FDV (Fully Diluted Valuation) can provide a more accurate estimation of their value, especially for meme tokens.

It's calculated by dividing 24h Volume by Market Cap. A higher value associates with greater popularity and increased susceptibility to rapid price fluctuations.

About Jito JTO Coin (JTO)

The Largest LSD Project on Solana

In the analysis of "Solana Price," it is mentioned that the development of the ETH ecosystem is saturated, lacking new narratives. A significant influx of institutional funds into Bitcoin has led to a gradual stabilization of Bitcoin's price, with the wealth effect becoming less apparent. Investors holding Bitcoin earn far more profits from investing in the Bitcoin ecosystem than from holding Bitcoin long-term. This situation is very similar to the development of Ethereum itself.

The differences between Ethereum and Bitcoin are growing, so investors are more inclined to find other public chains that can compete with Ethereum and replicate its narrative. Currently, Solana seems to be the only project capable of competing with Ethereum, which is the main reason Solana's token has surged from $19 to the current $70. The rising price of public chains, in addition to gaining more investor attention, also leads to rapid development of top projects in various tracks of public chains. The price also has significant growth potential.

Jito is the leading LSD project on Solana. The key difference from other LSD projects on Ethereum is that, in addition to reinvesting borrowed tokens to earn rewards, Jito also offers MEV rewards. MEV is a common way to "profit" in the DEFI space, simply put, by identifying orders that consume a significant amount of Gas Fee and earning the price difference through intermediaries (usually MEV bots). The problem this causes is that orders with lower Gas Fees may take a long time to execute, or the Gas Fee of the order may be higher than the order itself. Users staking Solana tokens in Jito, in addition to staking rewards, can also receive MEV rewards.

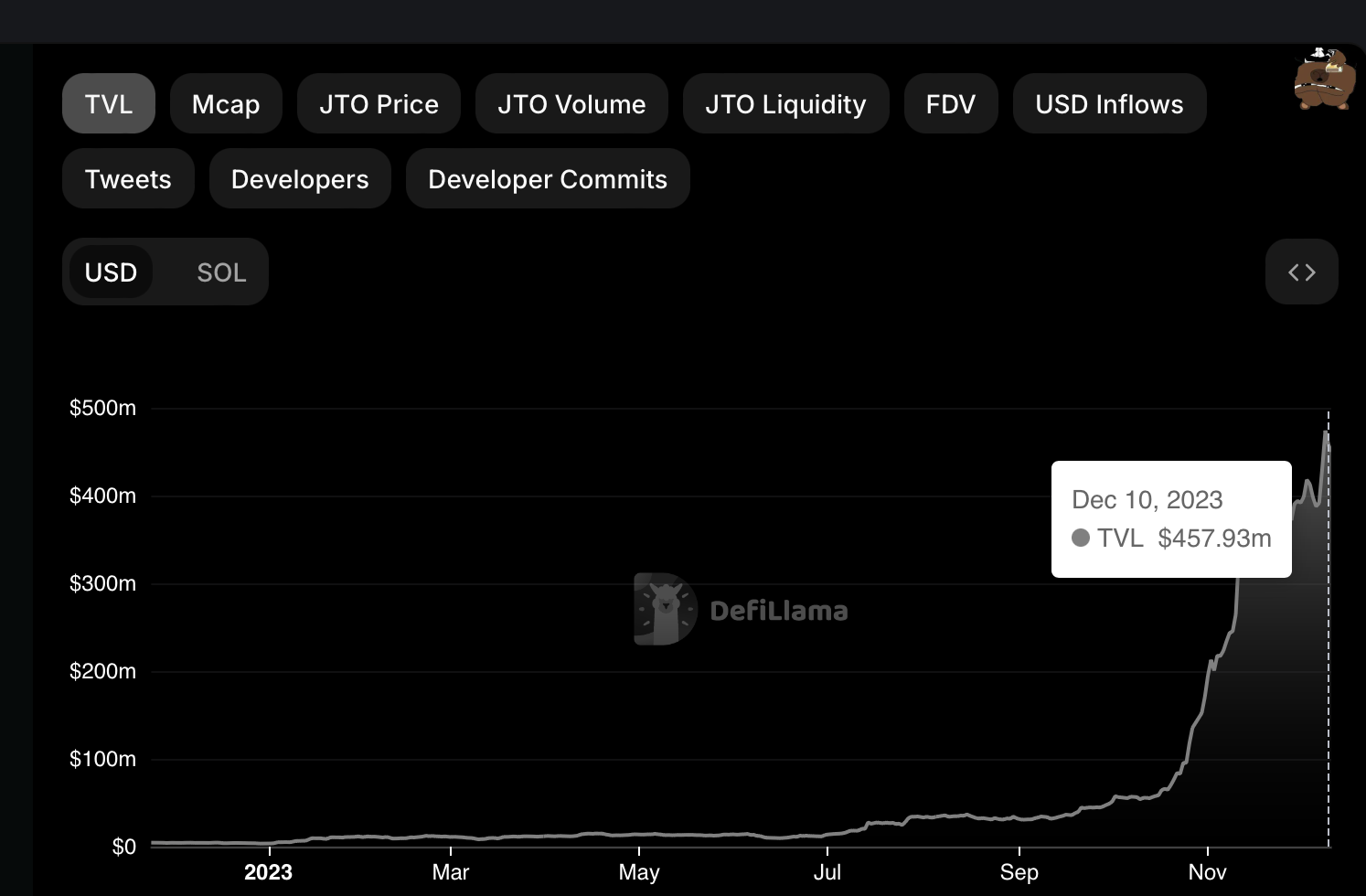

Jito is also the largest staking service platform on Solana, similar to Lido. JTO's Total Value Locked (TVL) has skyrocketed by a whopping 10 times in the past two months.

Jito's governance token is JTO, officially launched on November 28, 2023, and listed on the BingX exchange on December 8. On the day of listing, the price started to surge and reached a peak of $4.1 on the 9th (100%).

Jito Founding Team and Investment Institutions

Jito has a strong investment background, with lead investments from Multicoin Capital and Framework Ventures, and participation from Ventures and Anatoly Yakovenko, co-founder of Solana Labs.